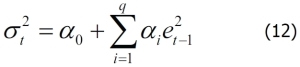

Based on previous arguments, we know that the volatility or variance of stock returns is not constant. According to the ARCH model, we could use the error terms from pervious estimation to help us predict the next volatility or variance. This model was developed by Robert F. Engle, the winner of the 2003 Nobel Prize in Economics. The formula for an ARCH (q) model is presented as follows:

Here,  is the variance at time t,

is the variance at time t,  is the ith coefficient,

is the ith coefficient,  is the squared error term for the period of t-I, and q is the order of error terms. When q is 1, we have the simplest ARCH (1) process as follows:

is the squared error term for the period of t-I, and q is the order of error terms. When q is 1, we have the simplest ARCH (1) process as follows:

It is a good idea that we simulate an ARCH (1) process and have a better understanding of the volatility clustering, which means that high volatility is usually followed by a high-volatility period while low volatility is usually followed by a low-volatility period. The following code reflects this phenomenon:

import scipy as sp sp.random.seed(12345) n=1000 ...