The term "quanto" is the abbreviation of quantity adjusting option. The payoff of quanto derivatives is determined by an asset denominated in one currency, but is paid in another currency.

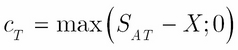

The best way to understand a quanto product (or any kind of derivative) is to examine its payoff function. It is well known that assuming the underlying asset is a stock that pays no dividend, the payoff of a European call option is as follows:

Here, SA is the price of the stock and X is the strike price. Here, c, SAT, and X are denominated in the same currency; let's call it domestic currency.

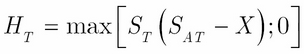

The payoff of a European call quanto is as follows:

Here, S is a foreign exchange rate. Thus, a call quanto pays the same "quantity" of money as a simple call option, but in another currency—let's call it foreign currency. So, this quantity paid has to be multiplied by an FX rate so that we get the payoff's value in domestic currency. Of course, S has to be the price of the foreign currency in terms of...