Opening balances – Suppliers

Dealing with opening balances for suppliers is similar to the method used for our customer balances. This time, we will be creating supplier bills for the amounts due. Again, there are different methods for creating opening balances, but we will stick with one preferred by professional advisors.

Creating supplier bills that reflect exactly what was owed before QuickBooks was put into use means that there will be values that match direct debits that appear on bank feeds, and there will be bills that we can agree to supplier statements:

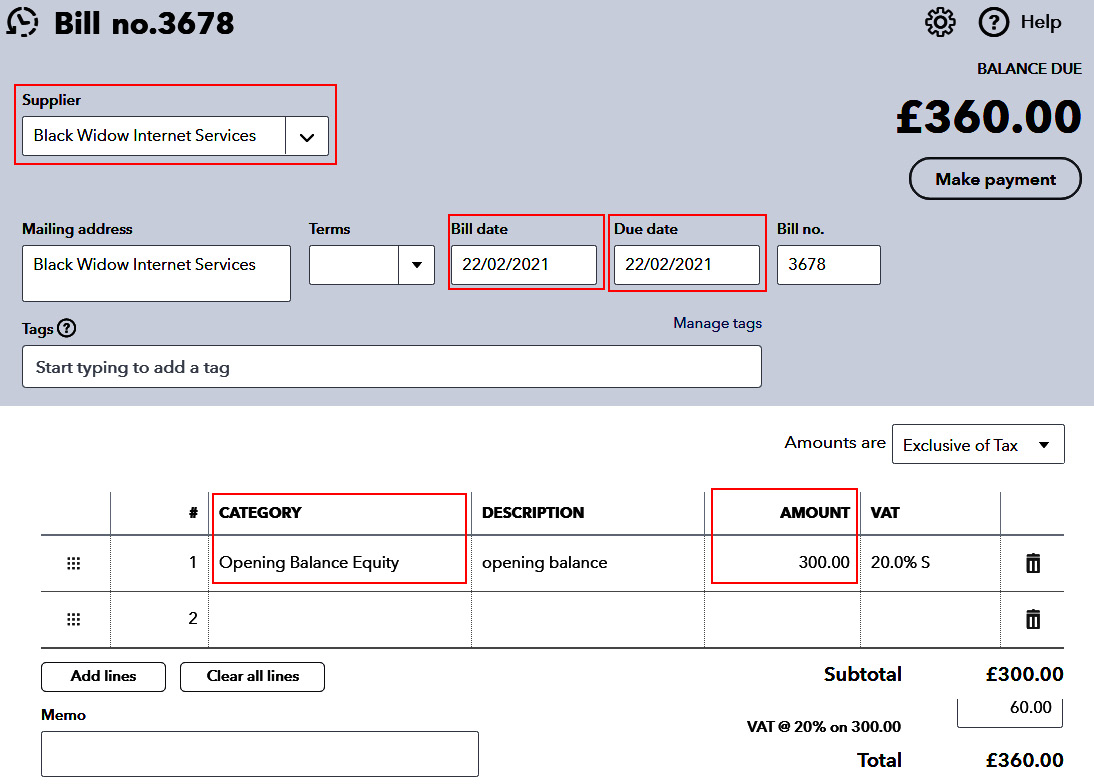

Figure 1.6 – Supplier bill input screen

The fields within the red boxes are mandatory when adding the supplier bill. Note the same chart of account code linked to the service item for customer invoices, that is Opening Balance Equity, is being used. All opening balance adjustments should affect the same account.

Just as in the case with customer balances, the VAT/GST will need to be accounted for if the amounts have not been included on previously filed returns. If the bill had already been included within a filed VAT return, it would have been entered as £360 NO VAT.

After all supplier bills have been entered (and if necessary, any supplier credits), the following reports should be checked to the date before the QuickBooks start date. For example, if starting from April 1, 2021, all the reports will be run to the date March 31, 2021:

- Accounts payable aging summary

- Accounts payable aging detail

- Trial balance

The first two reports should be compared to the details held within our old accounting records. It's important that the amount that QuickBooks reports as being owed to suppliers at our chosen start date is as expected.

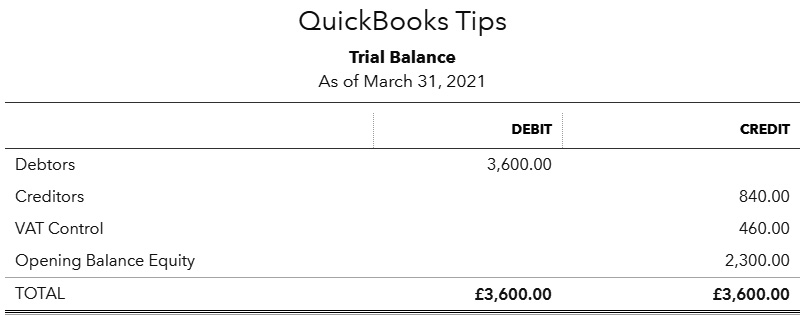

The trial balance report will now include creditors that will agree to the totals on the accounts payable report. In the example shown in the following figure, VAT Control has been reduced to reflect the purchase tax claimed on supplier bills:

Figure 1.7 – Trial Balance report after supplier balances updated

With opening balances in place for customers and suppliers, it is now time to look at ensuring the opening balances for any bank accounts are correct.